Proven Lead Generation & Recruitment Tools

Top carriers and producers choose Judy Diamond Associates for their sales prospecting and market analysis.

401(k) and Pension Lead Generation & Analysis

Find and win new business with easy to understand Red Flags, Plan Score Cards, Performance-based Benchmarking and Sales Talking Points.

Ideal for group retirement plan sales and marketing professionals.

Monthly billing option now available!

Employee Benefits Prospecting & Research

Secure a greater share of your market with current and comprehensive plan data, names, titles and email addresses for plan decision-makers. Upgrade to PLUS for detailed market share analysis on brokers and carriers.

Ideal for employee benefits sales and marketing professionals.

New pricing options & monthly billing are now available!

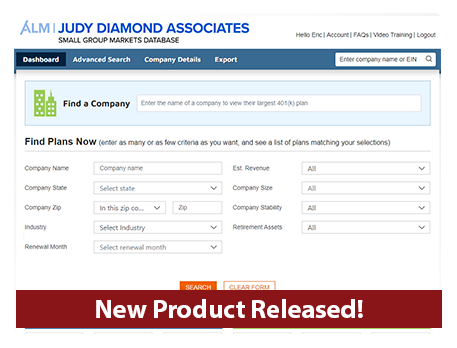

New to Judy Diamond: The Small Group Markets Database

The first lead generation tool that allows brokers and carriers to identify and target qualified employer groups with fewer than 100 employees

We can help you decide which is right for you

Get instant access to 5500 and EIN Data through our API using Judy Diamond Data as a Service (DaaS)