What about Research?

My last post I looked into how he tools a Judy Diamond Associates is able to help with your back office support. Specifically, we looked at how Retirement Plan Prospector is able to help with the marketing side of your work. From prewritten dynamic marketing letters to adaptive graphics and presentation-ready plan reports, RPP is able to up your marketing game.

But we all know that preparing for a sale is more than just squaring away your marketing and graphics. You need to know all you can about your lead. Not only that, you need to know how your lead compares to the client you prefer to work with. Moreso, which of the nearly 800,000 plans that are filed every year provide the best ROI of your valuable time?

Advisor Scorecard

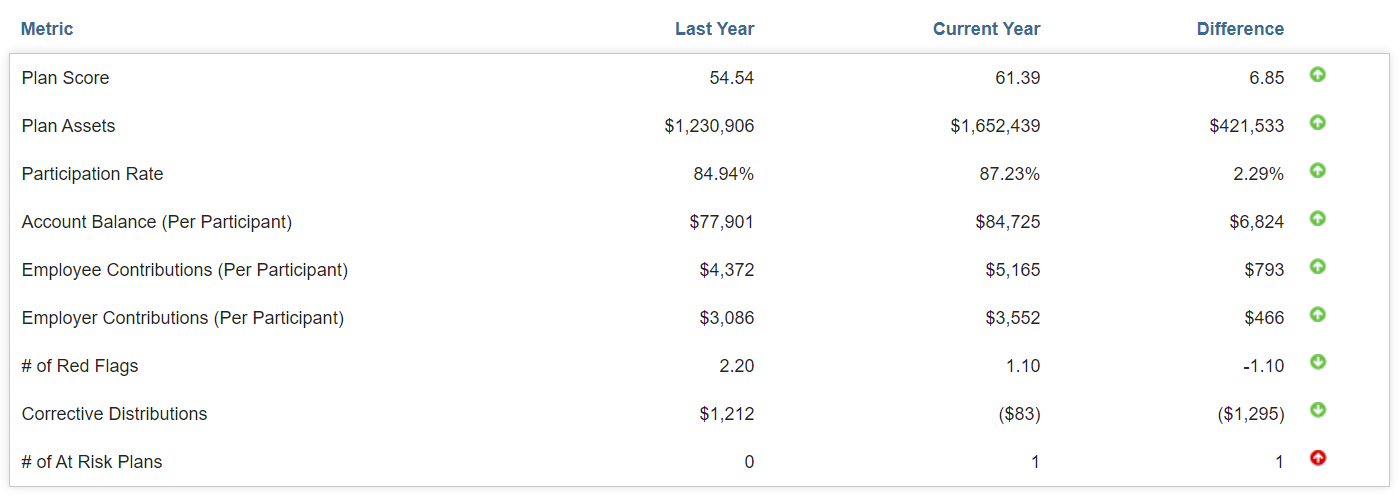

Analysis is not just something that looks outward. It also can be turned inward on your own book of business. The Advisor Scorecard helps you to determine and track the plans you currently have under management

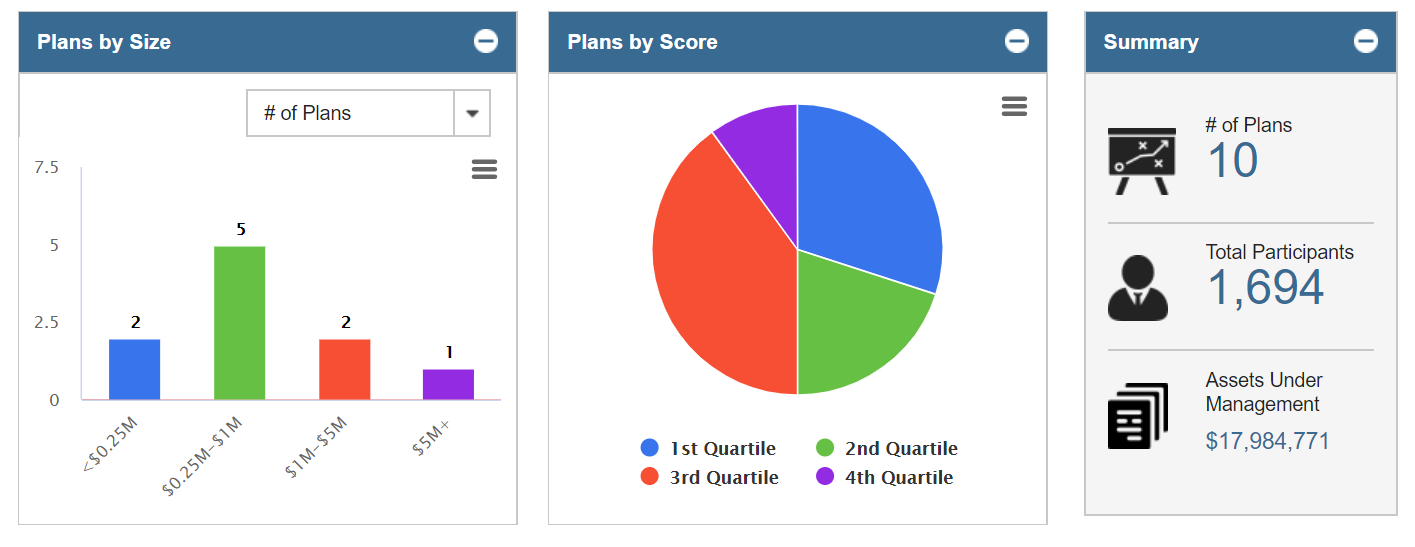

After adding their plans in your book of business into your My Plans files, Prospector focuses its  analytic tools to help. At the high-level view, you can maintain the general summary of your book of business (Number of Plans, Total Participants, and Assets Under Management). Additionally, you can see the breakdown of the plans under your management by Plan Size and Plan Score.

analytic tools to help. At the high-level view, you can maintain the general summary of your book of business (Number of Plans, Total Participants, and Assets Under Management). Additionally, you can see the breakdown of the plans under your management by Plan Size and Plan Score.

Plan scores look at the relative strength of a plan. By collecting the plan scores of all the plans in your book of business, you can come up with an average plan score for your clients. Comparing a lead’s low plan score to your “book of business score” is a great use of plan scores. Such a comparison is a data-driven reason for the sponsor to consider having you perform the same great work you did for your other clients.