In my last blog post, I wrote about the importance of preparing for a trade show. I had a chance to put my own advice into practice shortly thereafter when I attended the truly excellent Excel 401(K) show in Dallas. Because trade-show ROI can notoriously difficult to quantify, it is often one of the first things to go when belts and budgets need to be tightened.

As an exhibitor, I’m usually paying anywhere from $4,000 to $10,000 for my booth space, plus another $1,000 shipping, $500 (minimum) in booth furnishings, and $1,000 in personal travel expenses…and these are only the dollar costs. The opportunity cost for my time out of office is often equally pricey, especially if I’m sending multiple people to a show.

Let’s dive into the Top Four Considerations which make a show a “must attend” as opposed to a “could lose it if I had to”… How do we evaluate which shows to keep and which are destined for the chopping block? I generally look at four key metrics; New Business, Existing Business, Competitors, and Referrals.

New Business

This is the number one driver for an exhibitor like me. Do I think that I’ll make enough new connections at this show to fill my pipeline, and then convert them into clients, to pay off the show? Evaluating potential new business generation from a trade show is a combination of two functions: The number of attendees at the show, and the quality of these attendees.

Number of attendees

You’ve got to have a critical mass of people. 100 people aren’t going to cut it. 300 is about the absolute minimum I’ll even consider, and even then, the exhibiting price had better be pretty low. 700-1,000 attendees is where I like shows to be.

Quality of attendees

This critical component is often overlooked. Are the people I can expect to meet with at the show capable of buying my products? I’ve found that when I’m considering a new show I can often request a list of the attendees from the previous year’s conference. Even if you can’t get names, at least get a combination of company+title. What I’m looking for here are people with purchasing authority, or who may be senior influencers with my buyer.

Since I often sell to exhibitors, I include them in this category. One of the items that make a show a slam dunk for me, specifically, is when someone who actually signed one of my contracts is going to be at the show in person. Not only does that mean we can grab some coffee and strengthen our relationship, but also means that there may be others like that person in attendance.

Existing Business

A subscription-based business like mine grows on new sales but survives on renewals of the existing book of business. When considering a trade show, I will always look at the list of exhibitors from previous years (and, as noted earlier, the list of attendees) and do some quick math. Any show which has high-level representatives from 1/3rd or more of my existing client base is a must-attend.

Competitors

Sometimes, you can get lucky and just let your competitors do the homework for you! Any show that is hosting two direct competitors is something I’ve got to be at too. If there’s only one competitor, I’ll give it a good look, but there are definitely shows with a single competitor that I’ve taken a pass on.

Exhibiting at a show where one of your competitors is not only allows you to take advantage of their homework, but also lets you be on hand to answer that important question; “how are you different from X”. Some attendees might not know that there is another option out there, and others may be interested in seeing your different approach to solving the same problem. Be sure to be able to clearly articulate your value proposition and what makes you different.

Referrals

Of the 100+ shows I’ve exhibited at over the last 16 years, every single one has had some downtime when the exhibitors could mix and mingle with each other. When that happens, we almost always talk shop, and three questions consistently come up:

- How has your foot traffic been this show?

- Are you guys coming back next year?

- Where else do you guys exhibit?

Some of the best shows I’ve found are the ones that were recommended to me by my fellow exhibitors. New shows are always popping up, and as we discussed earlier, there is a significant expense associated with exhibiting. Getting the “seal of approval” from other exhibitors who are trying to reach the same audience I am is a big green flag that a new show is worth my time.

Trade shows are a critical part of the sales process for both individual subscribers and enterprise-level accounts. Making sure that you can select the right show to attend and that you maximize your time there (https://www.judydiamond.com/blog/making-the-most-out-of-trade-shows/) is essential for every sales manager.

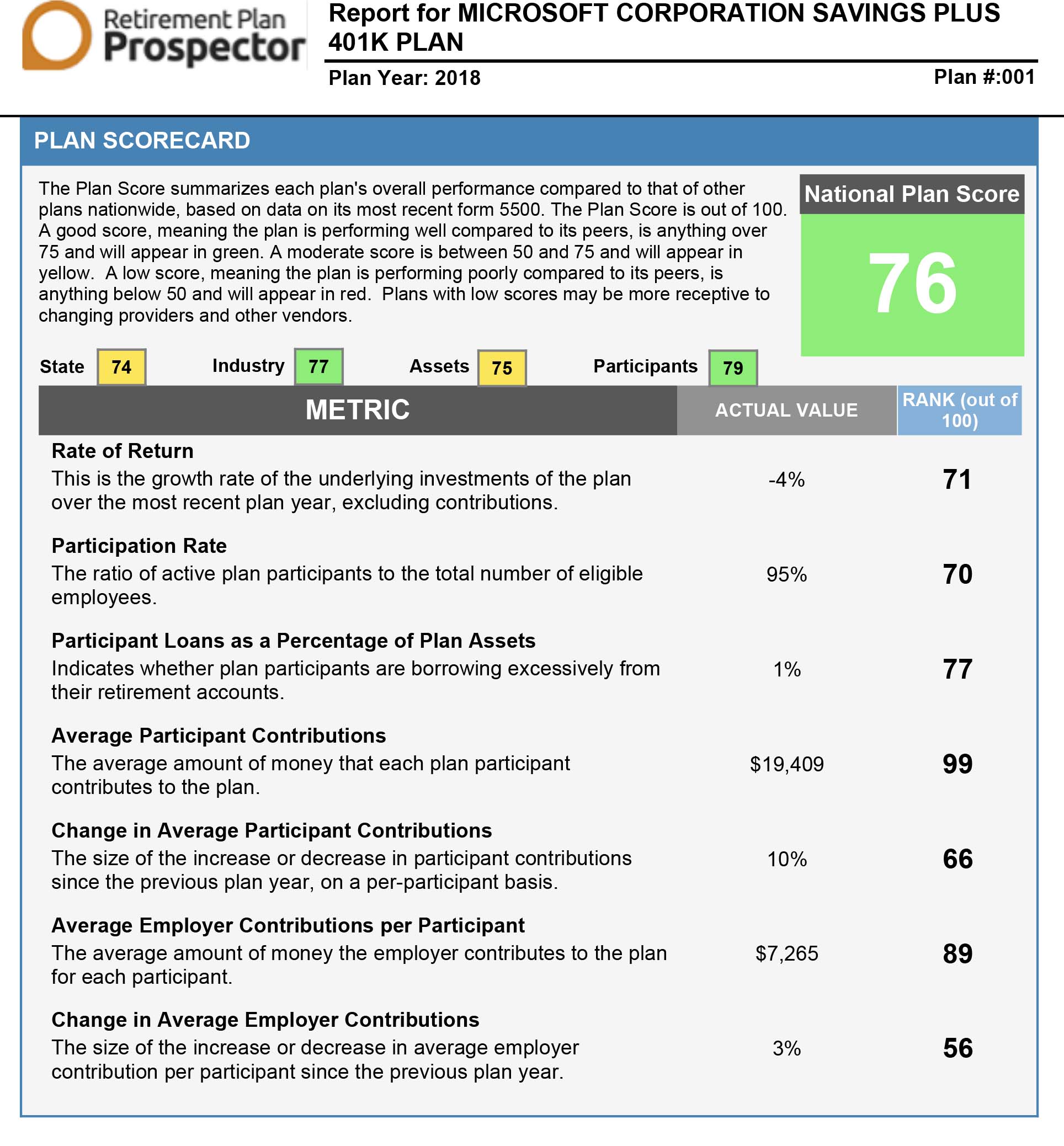

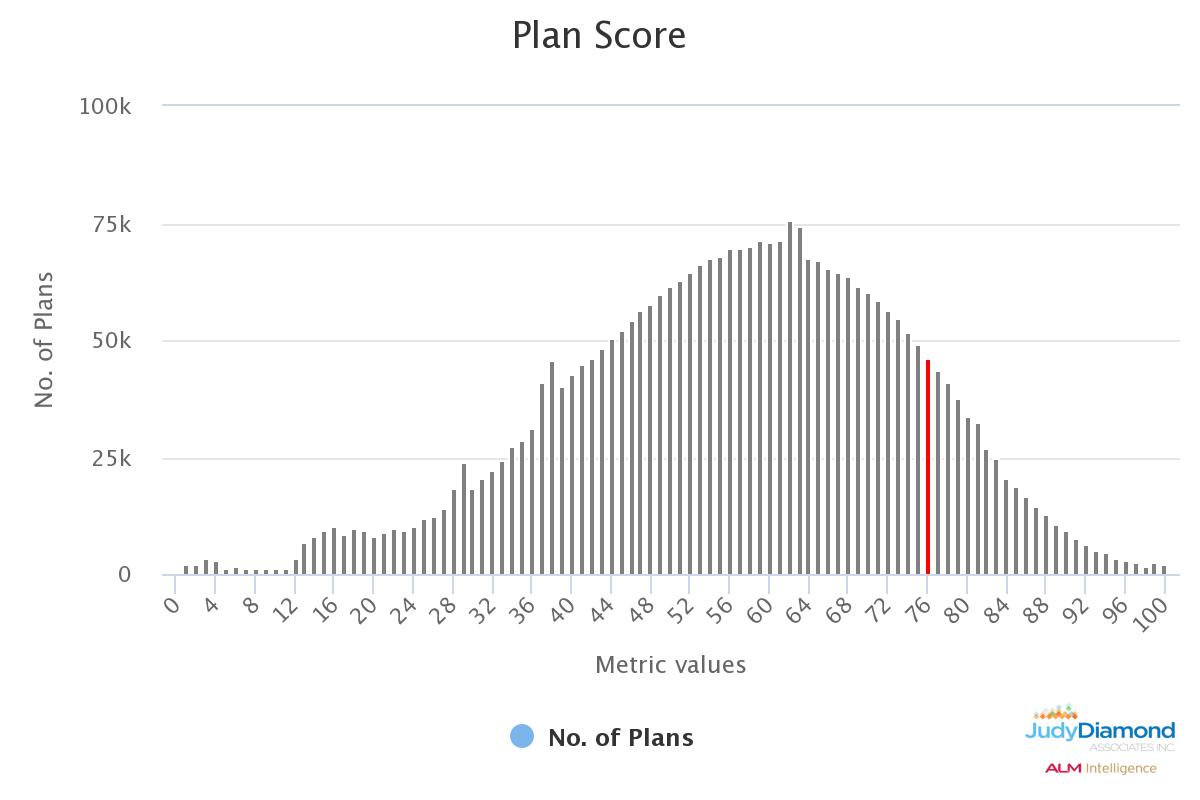

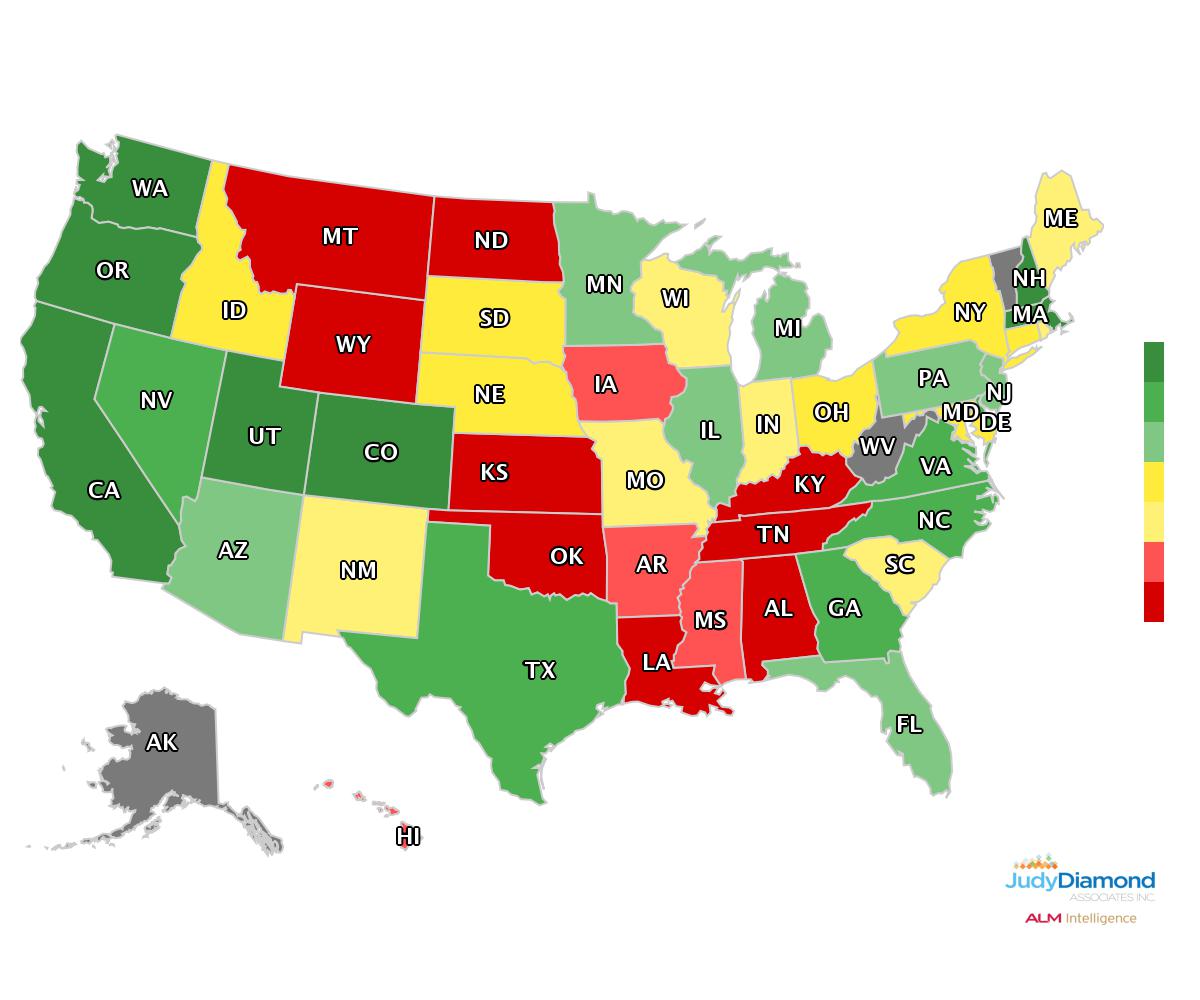

It is also a good idea to present your pitch using multiple modes of communication. While you are going to be speaking your potential clients, remember that not everybody learns or retains information the sale way. For instance, while listening to a speaker may help some, others are more visual learners and react better to charts and graphs. Still others prefer to read the material to listening to a speaker.

It is also a good idea to present your pitch using multiple modes of communication. While you are going to be speaking your potential clients, remember that not everybody learns or retains information the sale way. For instance, while listening to a speaker may help some, others are more visual learners and react better to charts and graphs. Still others prefer to read the material to listening to a speaker.