In this post, we are going to focus on one of Judy Diamond’s proprietary data points – Red Flags and how to use them in prospecting. Red Flags are an innovation pioneered by JDA based on 30 years of experience with the Form 5500. The idea behind Red Flags is to identify retirement plans that have a noteworthy characteristic that is not entirely obvious. While many of the Red Flags point to potential problems, whether it be with performance, plan design or administration, this is not always the case.

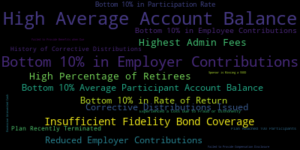

There are nineteen Red Flags identified as important relative to prospecting. Over the coming months, we will focus on one or more of these flags to provide a more detailed explanation along with some tips on how to use them in your practice. For a complete list of the 19 Red Flags, click here.

The first Red Flag we will consider is High Average Account Balance.

Most Frequently Occurring Red Flags

High Average Account Balance

High Average Account Balance is the most widely occurring Red Flag showing up in 401(k) plans. This accounts for nearly 200,000 plans in the 2017 plan year. This is not surprising considering the median number of participants (10) and the median participation rate (100%) for plans with this flag. So what is going on here and is it good or bad when focusing on prospecting?

High Average Account Balance is an example of a Red Flag that can be considered a positive screen. This Red Flag helps to find plans with few participants and participants with a higher than average 401(k) balance. The average 401(k) balance is $106,000 according to USA Today. Plans tagged with High Average Account Balance in the JDA Retirement Plan Prospector database have a median account balance of $182,778 – a staggering $77,000 more.

What Types of Plans Have this Red Flag?

What types of firms make up these plans? Physicians, Lawyers, Dentists, Financial Advisers, and other professional services firms comprise the majority of these plans. This includes wealthy professionals with small group practices or partnerships that are able to save the maximum in their retirement accounts.

Knowing how to find these types of plans can be helpful in two ways. First, the business owners and participants are one and the same with these plans. As a result, it is much easier to get their attention regarding plan design or performance issues. Therefore, whether it is high fees, poor fund selection or performance, you should be able to make a strong case to one of the business owners that it is in their best interest to meet with you. Secondly, these companies and individual participants are not only valuable retirement prospects but can also be targeted for wealth management services. As a result, since there are so many plans with this flag, it is relatively easy to find them in most geographic locations.

In future posts, we will take a look at some of the other most prevalent Red Flags. These include Bottom 10% in Employer Contributions and Insufficient Fidelity Bond Coverage.