Back Office Support in the Retirement Space: Marketing and Graphic Creation

October 29, 2019

Here at Judy Diamond, we often find our retail level clients face unique challenges. Frequently these users are the members of small teams, if not the only person at their office responsible for bringing in new business to their firm. Perhaps they are members of a larger firm with dedicated support teams, but others are vying for the resource. Many clients are new to the business. They come to us looking to learn how to sell in this space as quickly as they can.

In the end, each of these groups come to us because they need some “back office support” to meet their sales goals in the most efficient and straightforward path possible.

What is this “Back Office Support”?

A big challenge for these clients is how to do all the activities required to bring in new business while maintaining their current book of business. Tasks such as:

- Benchmarking analysis

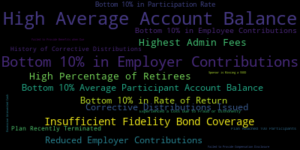

- Determining what plans in a market are weaker than others and explaining these weaknesses to plan holders

- Writing marketing letters for direct or email campaigns

- Creation of presentation-ready reports and graphics

- Dig up information on businesses current plans

I like to call these tasks “Back Office Support”. These are support tasks often provided by knowledgeable staff focused on helping you win over your client. Larger firms often have dedicated departments of experts devoted to these support tasks. However, at smaller firms, these support roles are usually rolled up into the hands of the same person responsible for bringing in the new business.

With so many tasks falling onto one person, organization and efficiency become even more critical.

Judy Diamond listened to the needs of these clients. We spent two years building Retirement Plan Prospector Plus (RPP+) to do just that: Act as your marketing, graphics, and research departments so that you can walk into your next meeting with everything you need to move along your sales cycle.

In this series of posts, we will look at how to take advantage of the edge RPP+ gives you. Let’s first look at how RPP+ can support your marketing and graphic design needs.

Marketing Letters

After you know who you want to reach out to, your next step is to decide on messaging. What do you want to say to these leads? How can you get your value proposition across effectively? When starting a new business campaign, larger firms may bring in assistance from their marketing department. The marketing team often provides two essential tasks to help the salesperson.

- Make sure the copy, or text, conveys the message the salesperson wishes to send out using the best tone and voice possible.

- Layout the text in an attractive and easy to read format

While having a whole team of marketers helping craft your messaging is the best way to go, RPP+ can help those whose firm does not have a dedicated marketing team. It can also act as a stand-in for those firms whose marketing teams are unavailable.

Those who do not have access to a dedicated marketing department can turn to the RPP+ module for support. This add-on module grants users access to professionally written marketing ready for you to use! These letters are not only crafted by our knowledgable team, they are also tied into our powerful RPP+ data. This means the letters pull in plan details specific to the business you are reaching out to. They are also easily downloaded so that you can make any adjustments to the letter (if you wish).

In no time at all, you have copy ready to be included in your next email or direct mail campaign!

Presentation-ready Reports and Graphics

Often when you are putting together your materials for a meeting with a potential client, it’s a good idea to include graphics. Graphics are a great way to take complex material and make it more easily understandable. Additionally, graphics help pull in clients who are more visual learners.

However, not everyone has the time or inclination to learn how to create graphics packages of their own. If you work for a large firm, the marketing department might be able to build some charts or format a few graphs for you…if they have time. But even then, you have to worry about collecting the data you need, give it to the graphics expert, explain to them what the data means and how you would want it shown. This would likely take several emails back and forth, plus the additional call or two, to sort it out.

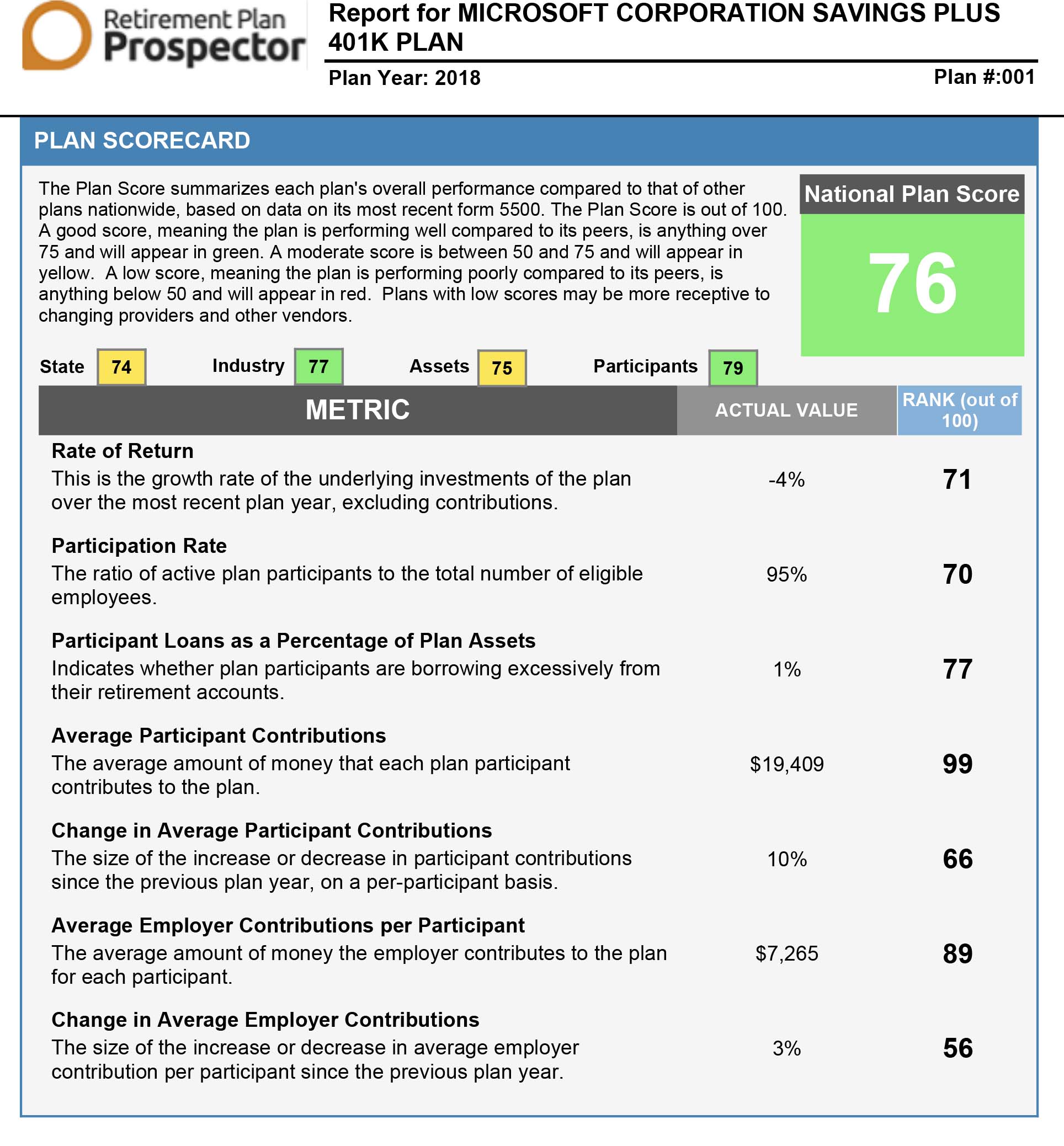

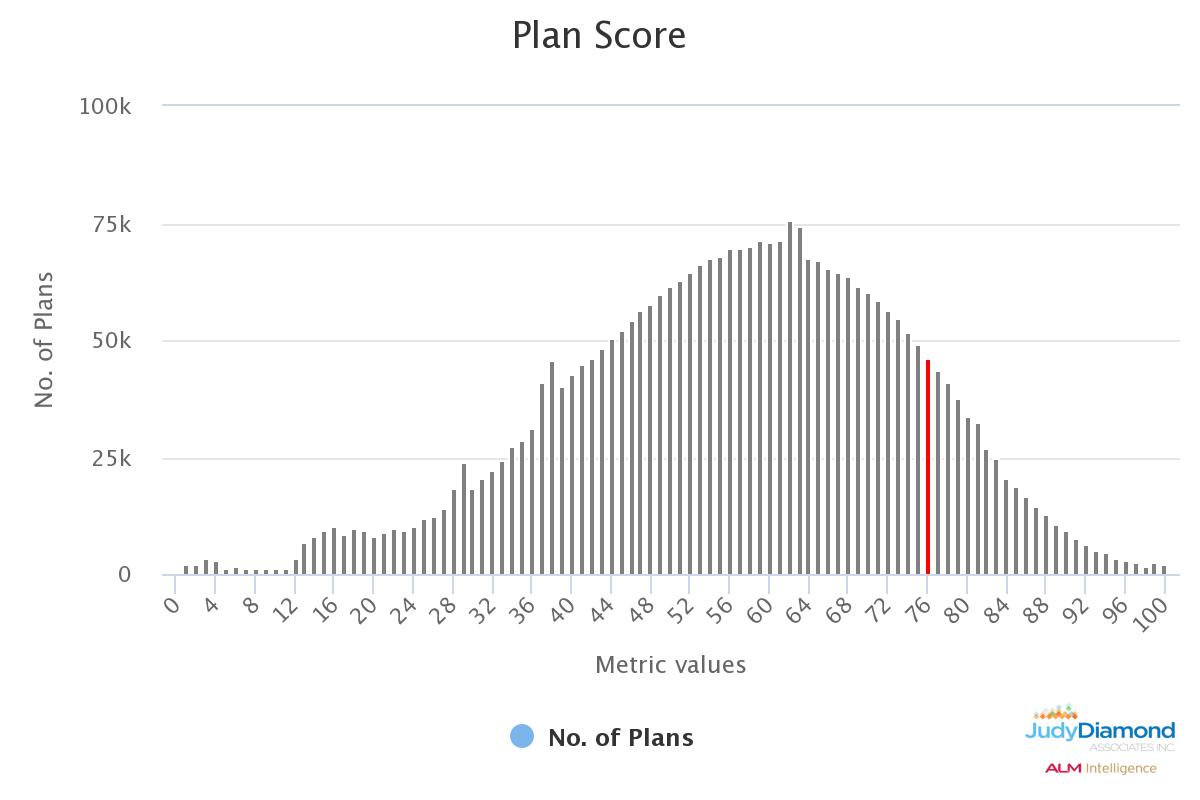

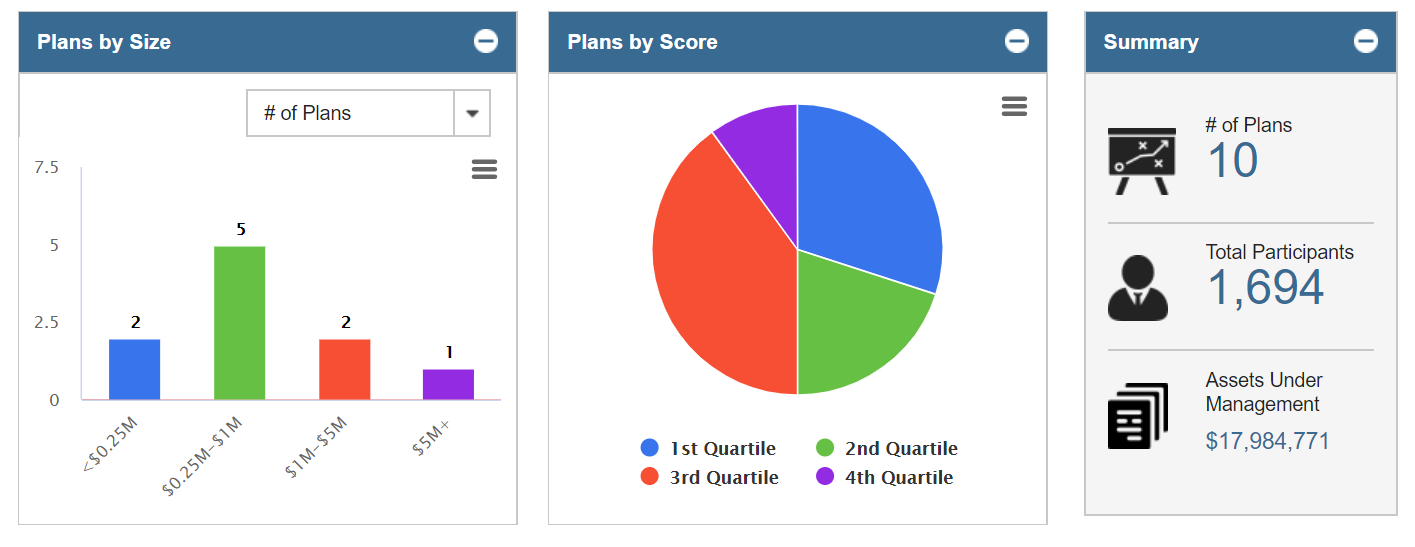

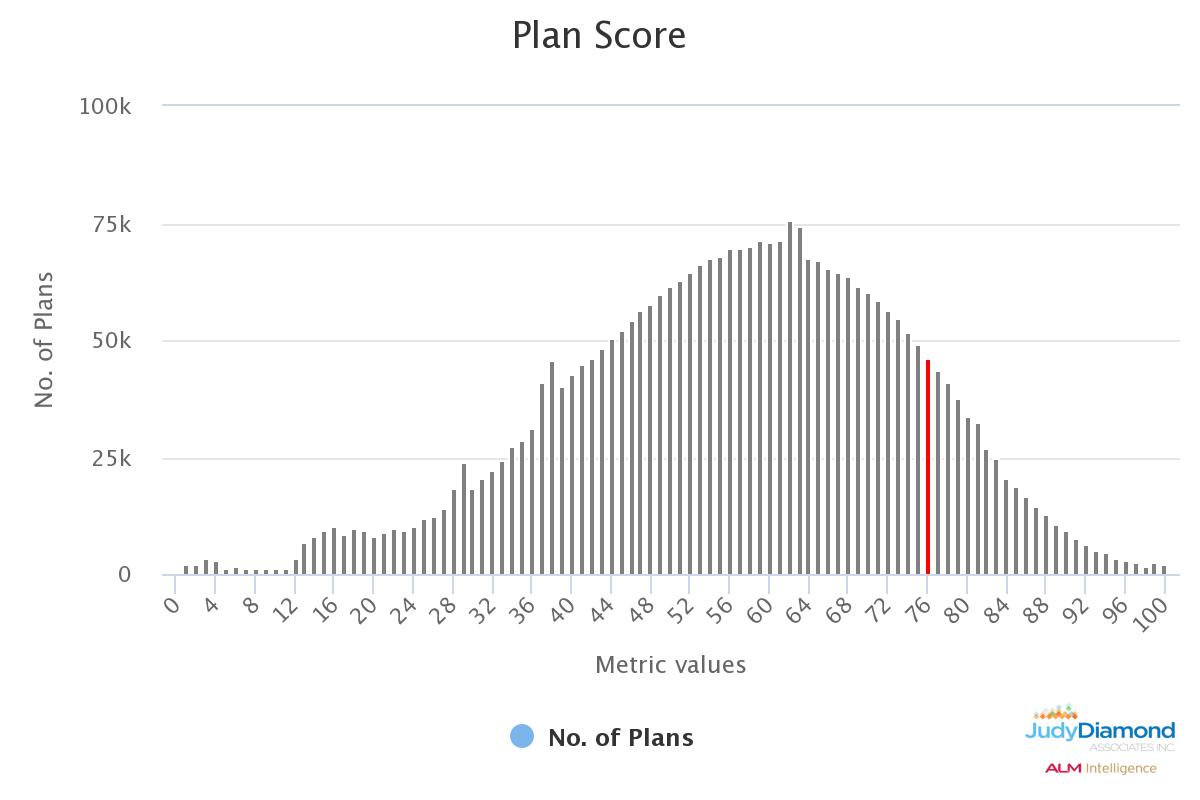

Our RPP+ module reduces the need for all this hassle by providing attractive and easy to understand charts and graphs ready for our clients to use. If you were want to show your client how Microsoft compares to other software publishers, you can! By accessing RPP+’s Benchmarking tools, you can quickly build a peer group containing software publishers. Then, which a couple

of clicks, you can generate a graph comparing Microsoft’s Plan Score against over 2,000 other companies in the same market.

No worrying about collecting data, now worrying about if the graph correctly represents the data. In under a minute, you have a graphic ready for you to drop into your report.

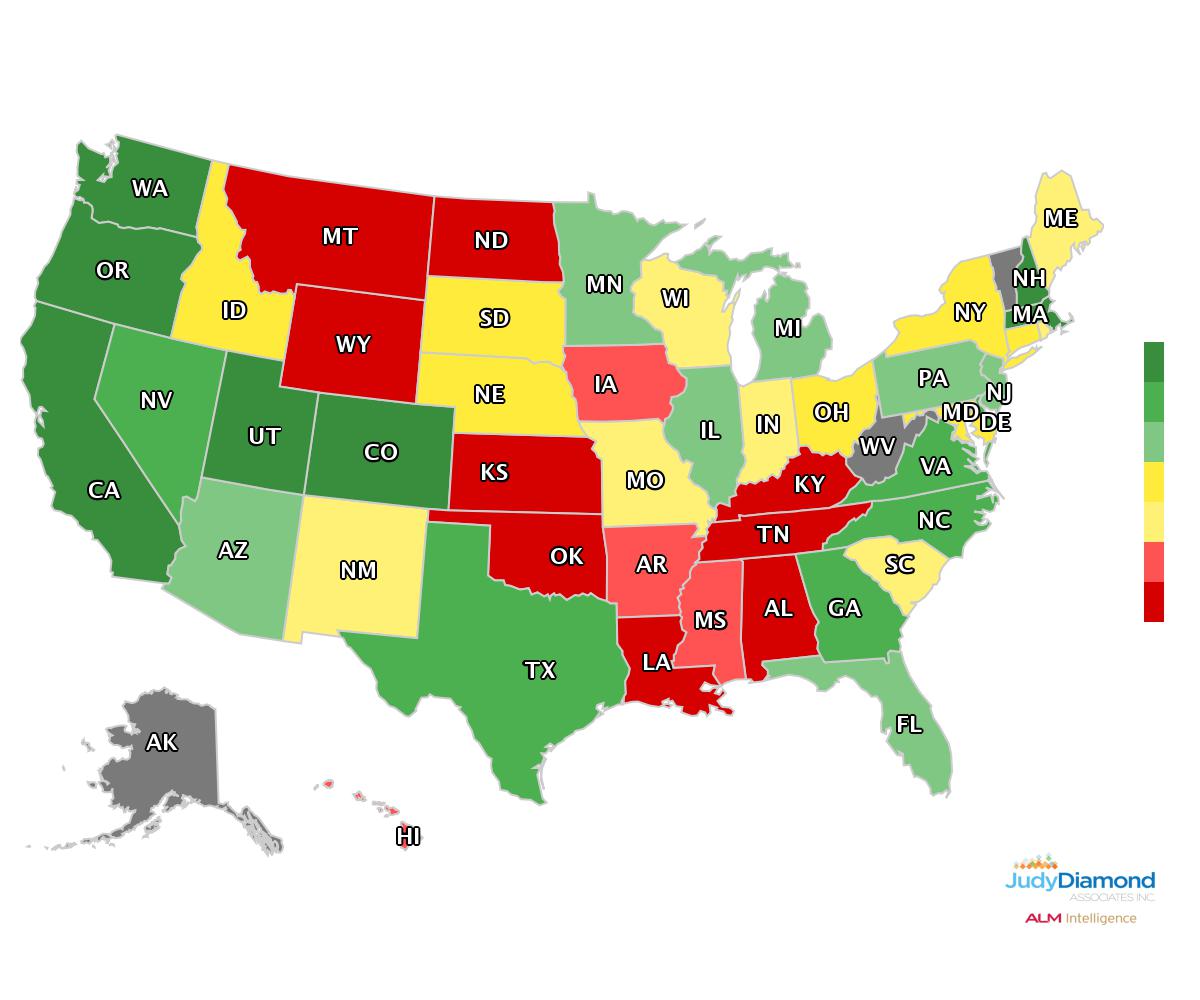

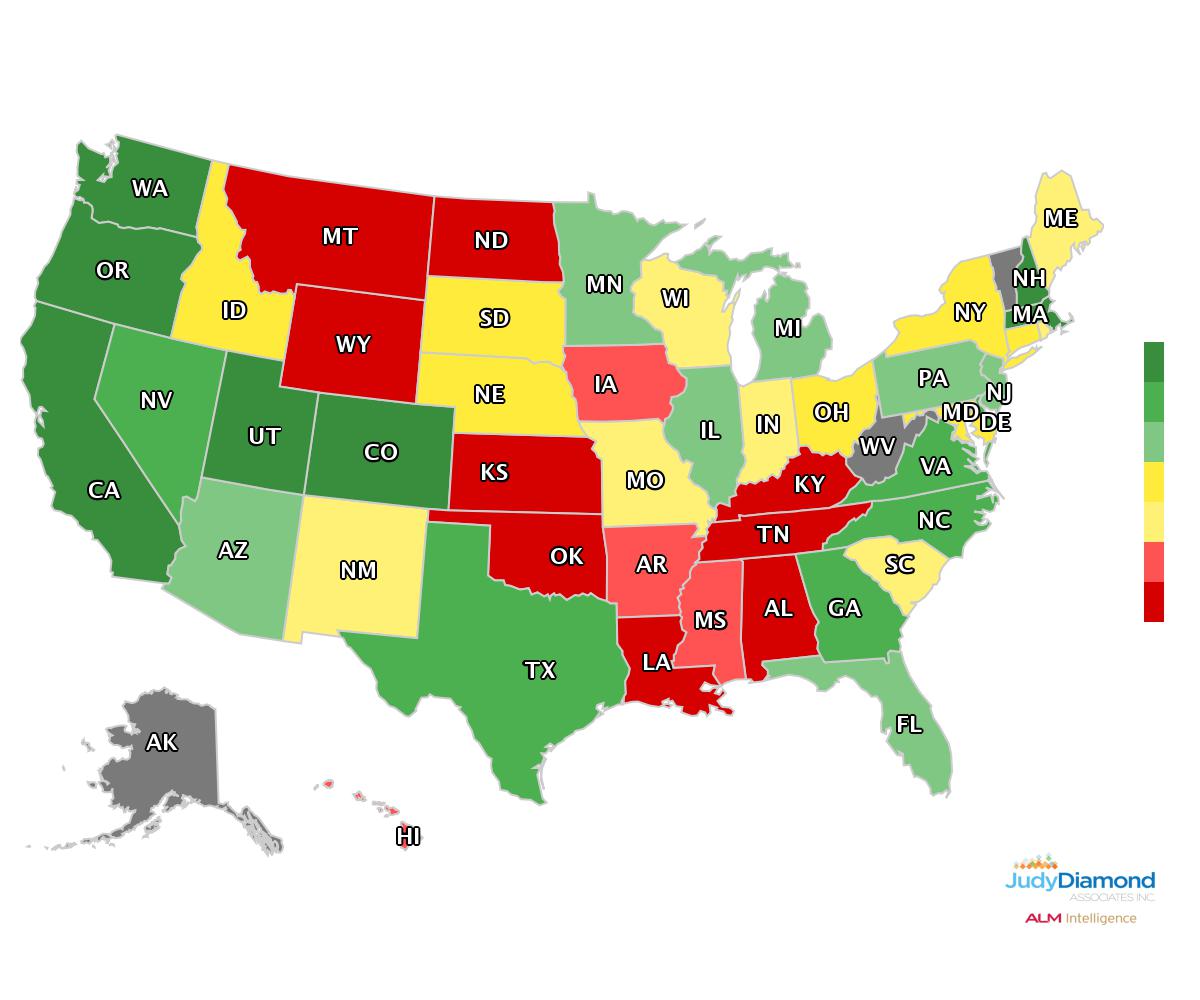

Let’s say you need a heat map showing what states or counties have Software Publishers. Once again, in a few seconds, you can have a graphic pulling on that same data pool of over 2,000 different sponsors.

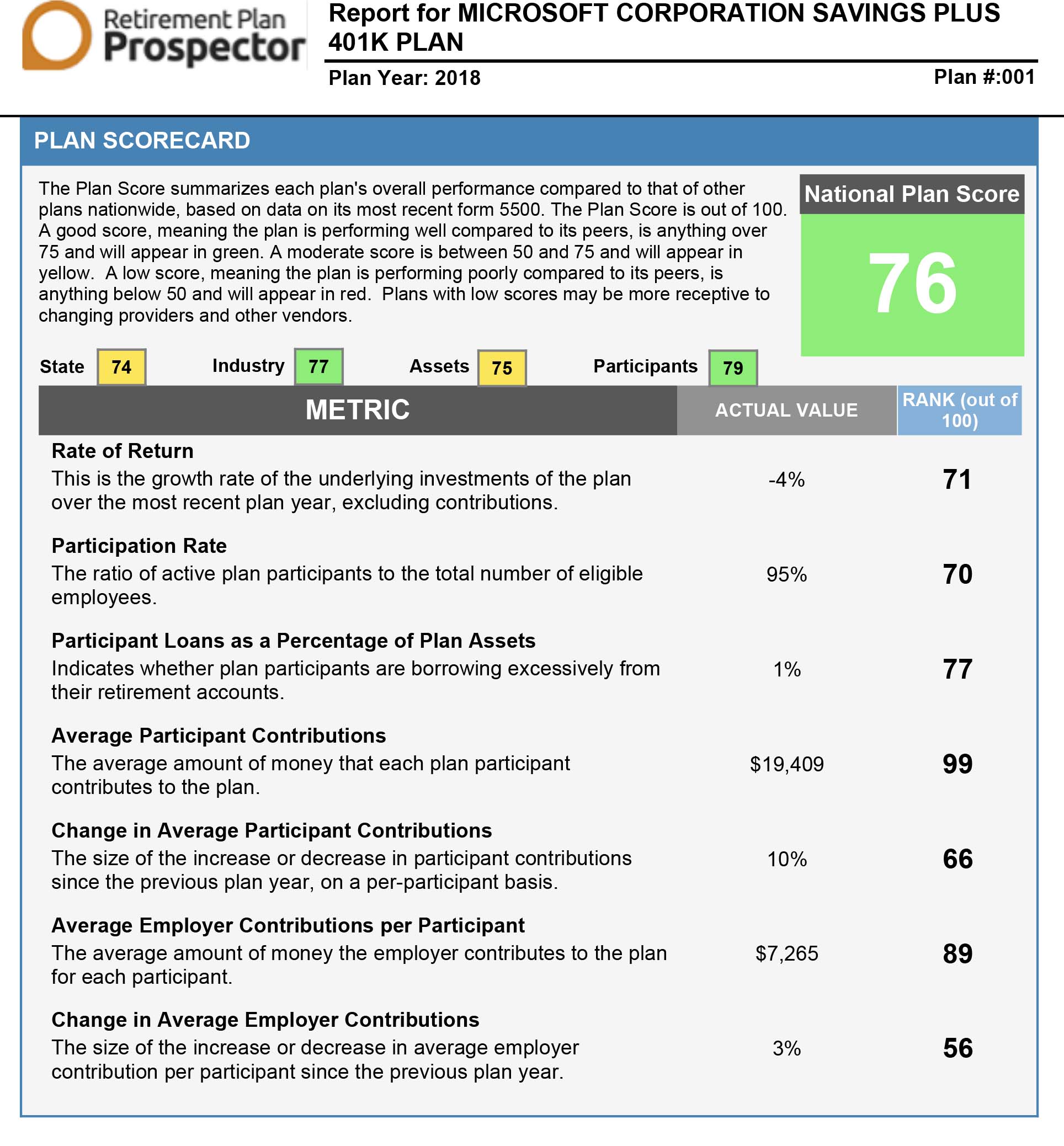

But RPP+ goes even further. Not only are we able to provide these single graphics for you, but we also provide each RPP+ client with our presentation-ready plan reports. These adjustable reports pull all the data that you receive with your RPP+ account into a multipage PDF. You get to select what information you want to include in the report. You get to choose

What about Research?

But we all know that preparing for a sale is more than just squaring away your marketing and graphics. You need to know all you can about your lead. Not only that, you need to know how your lead compares to the client you prefer to work with. Moreso, which of the nearly 800,000 plans that are filed every year provide the best ROI of your valuable time?

In my next blog, we will go into how RPP+ can act as your back office Research team providing you with the data you need.

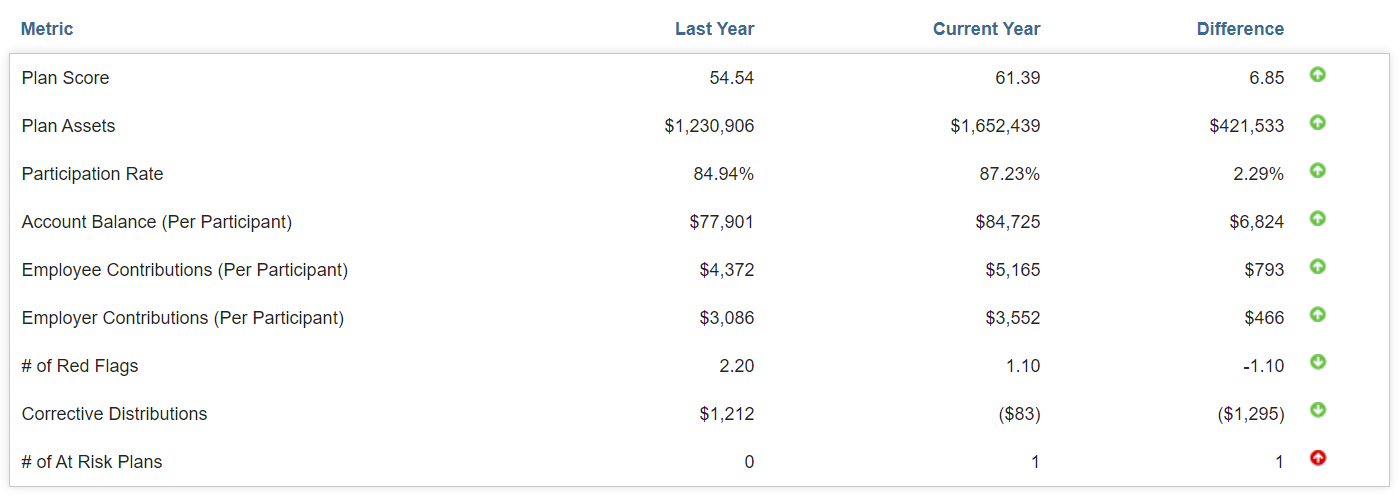

analytic tools to help. At the high-level view, you can maintain the general summary of your book of business (Number of Plans, Total Participants, and Assets Under Management). Additionally, you can see the breakdown of the plans under your management by Plan Size and Plan Score.

analytic tools to help. At the high-level view, you can maintain the general summary of your book of business (Number of Plans, Total Participants, and Assets Under Management). Additionally, you can see the breakdown of the plans under your management by Plan Size and Plan Score.

It is also a good idea to present your pitch using multiple modes of communication. While you are going to be speaking your potential clients, remember that not everybody learns or retains information the sale way. For instance, while listening to a speaker may help some, others are more visual learners and react better to charts and graphs. Still others prefer to read the material to listening to a speaker.

It is also a good idea to present your pitch using multiple modes of communication. While you are going to be speaking your potential clients, remember that not everybody learns or retains information the sale way. For instance, while listening to a speaker may help some, others are more visual learners and react better to charts and graphs. Still others prefer to read the material to listening to a speaker.