My favorite part of the Form 5500 is the Schedule A. Here’s where we find the meat of health and welfare plans, the insurance contract disclosure and any brokers that sold the policy. Retirement plans will fill out this Schedule as well if they have an annuity contract. But for the purpose of this article, we’ll focus entirely on how to interpret a Schedule A on welfare plans. This article is an introduction, and you can check out its follow-up for building more nuanced searches.

Given how integral it is to either developing broker relationships or assessing competition, there’s a brevity of fields on the Schedule A. Never fear! Judy Diamond Associates has spent years supplementing the data and making connections so that you can work more efficiently and effectively. Below is a list of the most commonly requested data points.

Carrier Name

This is the carrier who is assuming the risk for the benefits selected on the Schedule A. You’ll only see one carrier per Schedule A. Fun fact, sometimes a sponsor name will show up in this field. I take this to mean they’re self-insuring the benefits.

Renewal Date

This usually is identical to the plan year beginning and end date. However, I like to point it out because sometimes you see a policy that ends mid-plan year abruptly. Always worth investigating!

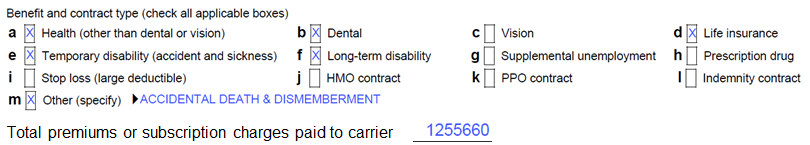

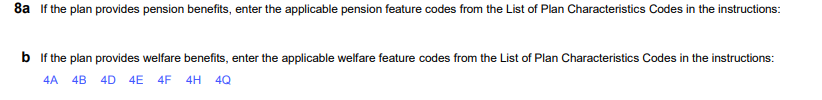

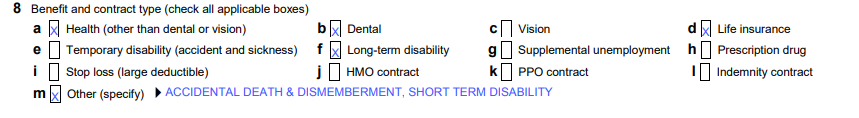

Carrier Benefit Codes

This list of health and welfare benefits was determined by the DOL and has only 13 codes that run through the letters A – M. This is isn’t to be confused with the Form 5500s main page’s Plan Types descriptions (Section II, Field 8a) where a sponsor identifies what they’re offering to their participants. These codes are only for the policy in question and may provide a bit more detail than the Play Types. For example, in addition to the option to select Health a carrier could use HMO or select Health and PPO as a qualifier.

You might have noticed that JDA has 26 codes in their tools. That’s thanks to the next item, “Other” text entries.

The “Other” Text

When a carrier marks code M for “Other” they need to fill out a brief description of what that “Other” benefit includes. That text is searchable in The American Directory of Group Insurance, but we realized early on that it was going to be like hunting for a bent needle in a haystack. That’s because there are no guidelines on how to report benefits. So we created a process to identify the most frequently filed write-ins and created an additional 13 categories just for them. That way you’re not struggling to figure out if Accidental Death & Dismemberment was disclosed as AD&D, AccD&D, Accidental Death & portDismemeberment (that typo is intentional in this article but probably not on the policy), or any other variation you can imagine!

Lives Covered

The number of individuals covered by the policy. Caution, there’s potential for confusion here. The DOL’s instructions indicate on the Form 5500 that participants should be either current or former employees or members of the sponsor. The Schedule A’s instructions say to disclose who is covered by the policy. Some carriers interpret this as spouses, dependents, and participants because their lives covered count exceeds the Total Participants field.

Broker Name

In the fourteen years Managing Director Eric Ryles has been with Judy Diamond Associates, he’s never had a good night’s sleep. Why? Because the DOL has some fuzzy disclosure requirements on brokers. And it’s all thanks to this simple sentence:

![]()

What we see on 5500s is that there’s a broad interpretation of how to report that information. Maybe they list the individual but not the firm. Or perhaps it’s the firm, and no individual is registered (particularly common with the larger brokerages). But rarely do filers provide both an agent and the firm they work for.

Fortunately for you, Eric’s restlessness has become JDA’s restlessness. Our dedicated team identifies connections between a broker and a firm and cleaning up data, so your prospect lists and market reports are representative of your search. That’s the core of our BCMS database.

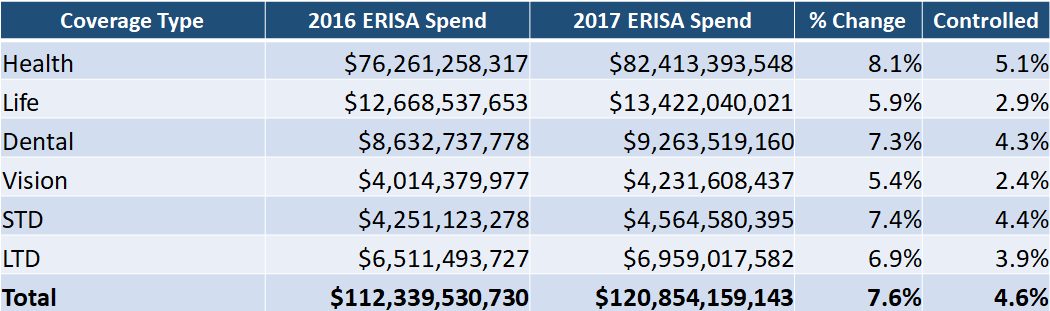

Premiums

This is the value of the contract for the benefits and lives covered. It’s a single-line field with no ability to clarify if the premiums were voluntary or determine how much each benefit on a multi-line policy earned. And yes, you guessed correctly, JDA has identified workarounds to that! Voluntary benefits are typically found on policies with write-in text, and as I mentioned above, that’s searchable. As for multi-line policies, we introduced our Modeled Premiums in late 2018 and continue to build out that model in both Group Insurance and BCMS.