In my previous post, I introduced a data point pioneered by Judy Diamond called Red Flags. These are the 19 proprietary flags identifying retirement plans with problems in plan design, administration or performance. Red Flags are a hugely valuable tool. This is especially so when searching the 5500 database to find prospects. Advisers can use Red Flags to highlight their strengths and present their unique value proposition to sponsors.

Red Flag: Bottom 10% in Employer Contributions

In that first post on Red Flags, we explored High Average Account Balance. It is the most widely occurring Red Flag among 401(k) plans. In this post we will take a deeper look at the Red Flag labeled Bottom 10% in Employer Contributions. It is the second most widely occurring Red Flag. Together, these two Red Flags make up a little more than a third of plans having one or more Red Flags. So, how can identifying plans in the Bottom 10% in Employer Contributions be useful for prospecting?

Sponsors offering a low or zero match for participants are generally smaller companies. Searching the database of 401(k) plans reporting in the most recent filing year (2017), we find about 118,000 plans. This is one of the reasons this particular Red Flag is so prevalent. Median statistics for this group show that these are indeed small plans with the median number of participants equal to 5 and total plan assets of $216,588.

Generally speaking, smaller plans offer fewer benefits and not providing a participant match is an easy place to reduce costs. Unless you specialize in the micro-market, this may not be the best place to focus your efforts. But wait. If we rank plans by plan assets, we see a different picture with many plans with hundreds of millions in plan assets.

Separating the Wheat from the Chaff

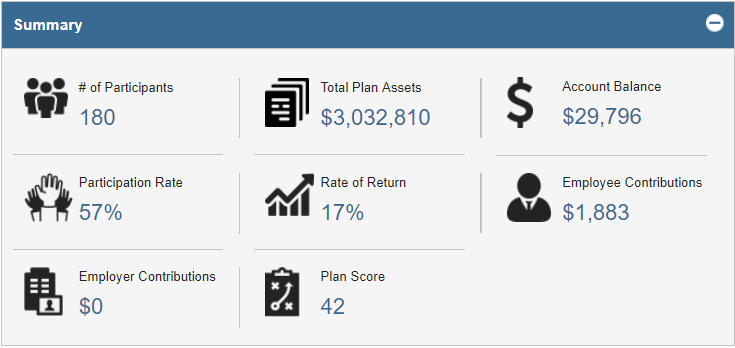

To get a better sense of what opportunities exist, let’s limit our list based on a measure of plan size. One such measure is the number of participants. When we do this and include only plans with 100 or more plan participants, we find 8,699 companies. And low and behold, the median total plan assets increases to just over $3 million. Now this is something we can work with as these larger firms will be more receptive to the benefits to be gained in employee recruitment, retention and participant outcomes.

Despite the vast number of smaller plans with the Red Flag Bottom 10% of Employer Contributions, this is still a valuable tool. But unless your focus is micro-plans, it may be best to use this Red Flag in combination with other criteria. One strategy is to include a measure of plan size such as total plan participants or total plan assets to find the best opportunities where sponsors may be more interested in increasing their match rate.